Uncertain Health in

an Insecure World – 65

“Urgency”

There is no human disease more feared than cancer in kids.

And among pediatric oncologists, there is no cancer more

feared than childhood acute lymphoblastic leukemia (ALL). A rare disease, ALL affects

3,000 young persons in the U.S. annually, often beginning with fever and

bruising, but quickly turning fatal if not aggressively treated at a specialized

children’s hospital. After a bone marrow aspiration confirms the diagnosis, treatment involves complex chemotherapy, irradiation and stem cell

transplant regimens. A shared sense of urgency to improve childhood leukemia

mortality has created novel ALL therapies, which have turned around its poor

prognosis into 98% remission and 90% ten-year survival rates at leading pediatric

cancer centers.

Researchers are now borrowing upon this pediatric oncology urgency

to promote precision medicine (PM) in other diseases.

Some ALL patients have the Philadelphia chromosome mutation (above),

described in 1960 by Peter Nowell and David Hungerford at the University of

Pennsylvania (below), who made the first direct link between a chromosomal abnormality

and any malignancy. Recent research from the U.S. Pediatric Genome Project

shows other gene mutations in the most deadly ALL subtype, early T-cell

precursor (ETP), which may direct future PM tailored therapies.

Bert Vogelstein’s 2013 Science article describes the “march of mutations” through a genomic

landscape which is the backdrop to the most common human cancers. Its “mountains” are genes altered in a high

percentage of tumors (below), while the “hills”

are infrequently altered genes. Over 140 cancer driver gene mutations have been

described, with tumors typically expressing between two to eight such genes

responsible for cell death, cell survival and healthy genome maintenance. Vogelstein’s

construct of the diverse cancer genome is fostering the development of

precisely targeted therapies.

In Boston last week, Siddhartha Muhkerjee (below), the

author of The Emperor of All Maladies: A Biography of Cancer, spoke of

his acute leukemia experiences as a pediatric cancer physician. He described

how the human body “slouches towards

cancer”, from one gene mutation to another. At a cellular level,

even seemingly similar cancers differ from every other cancer in terms of their

genetics and cell metabolism.

Fair warning from Sid – cancer biology is complex.

It includes organismal features – the physiology that keeps

cancer cells alive; environmental features – the immunologic systems causing cancer

cell destruction; and epigenetic features – the mechanisms that control cancer

gene transcription into messenger RNA (mRNA).

Along the path to cancer (above), there are multiple switches opening

and shutting cellular circuitry that largely exists like a massive iceberg

below the water surface. New therapies must precisely target this submerged iceberg

using personalized medicine approaches that are actionable.

Endogenous cellular sources of oxidative DNA damage via base

pair and nucleotide excision – so-called single nucleotide polymorphisms or

SNP’s – cause gene toxicity (i.e., genotoxicity) by inducing mutations in

tumor-causing oncogenes and in tumor suppression genes. Exogenous viruses and

chemical carcinogens can also promote mutations.

The WHO’s International Agency for Research on Cancer (IARC,

est. 1969) maintains a database on genotoxic and non-genotoxic carcinogens.

Most carcinogens are also mutagens (i.e., changing human DNA). Of >900

likely candidates, some 100+ are classified by IARC as carcinogenic to humans.

Because it takes years or decades for exposure to a carcinogen to cause cancer,

making such cause & effect linkages can be complex. Landfills are quickly

filling up with heavy metals and toxic chemicals that now permeate our ground

water. But the last new human carcinogen was described >15 years ago, and only

pre-natal ionizing radiation has been identified as a risk for ALL.

Synthetic biology can endow immune cells with new properties

for treating ALL, and offers potential for treating some solid tumors. The

widespread mutational burden of some diseases is a key to the success of a new

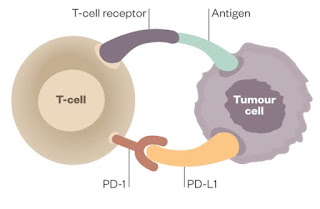

class of immunotherapies called checkpoint inhibitors. Activated T-lymphocyes

(T-cells) trying to kill tumor cells are neutralized when they attach to

specific T-cell PD-1 or tumor cell PD-L1 receptors (above). This T-cell

deactivation is prevented by the binding (below) of checkpoint inhibitors

(i.e. Opdivo™ and Yervoy™ from Bristol Myers Squibb; Keytruda™ from Merck Sharp

& Dohme), which have been effective in deadly metastatic melanoma, renal carcinoma

and some lung cancers. It is feasible that similar approaches will work in the

benign disease space and be used for tissue engineering.

Personalized medicine demands such precision.

PM will not succeed if it is based on “n of 1” clinical trials. New drugs can only move forward into

clinical use after phase-1/-2 safety studies are completed. The gold standard

for phase-3 randomized clinical trial (RCT) informed treatment protocols is to balance

therapeutic and toxic effects encountered in the average RCT study subject. But

every cancer in every cancer patient is unique, so new “smart surrogate” clinical trials will be needed. PM-informed

biological endpoints will replace standard RCT survival rates. So-called “basket trials” of regular cancer therapy

plus T-cell activating/suppressing immunotherapy adjuvants are being

designed.

The Roche Group acquired the remaining 40% of Genentech in

2009 for US$46.8B. On November 10, 2015 the FDA approved Cotellic™

(Roche-Genentech) for the treatment of BRAF V600E or V600K mutation-positive

advanced melanoma (below), in combination with Zelboraf™. The phase-3 coBRIM study,

started in 2012, combined Cotellic’s inhibition of MEK (a protein kinase like that above, phosphorylates the ERK gene regulating programmed cell death) and Zelboraf’s

BRAF (a proto-oncogene making B-Raf protein that directs cell growth) in order to

delay the onset of tumor resistance seen after BRAF inhibition alone. The

endpoint used in this gene-targeted PM regimen was progression-free survival.

It worked!

Today, Roche-Genentech has >20 anti-cancer molecules

(i.e., drugs) in its pipeline, and is committed to the treatment of children.

In July 2015, the National Cancer Institute (NCI) Molecular

Analysis for Therapy Choice (MATCH) launched a nationwide phase-2 clinical

trial to sequence the tumor biopsies of 3,000 patients, and match findings against

a 143 cancer driver gene panel. NCI-MATCH (above) will bring diverse Big Pharma

companies (including some that haven’t yet completed M&A transactions!; see post #63) together in PM-directed

sub-studies to jointly develop novel clinical treatment protocols involving

their otherwise proprietary blockbuster drugs.

We in the Square are heartened by all this urgency, and by

the coming together of market competitors to extend the lives of our patients,

not just their drug patents.