Uncertain Health in

an Insecure World – 59

“Wise Objects”

In the 1933 Marx Brothers’ masterpiece, Duck Soup, Groucho Marx played Rufus T. Firefly, the wise-cracking leader of a fictitious nation, Freedonia.

The name Freedonia originated in the American

Revolutionary War as a snub to British overlords. Not surprisingly, the small,

bankrupt, imaginary country had comedic public policy and no great

universities.

The evolution of post-revolutionary America continues.

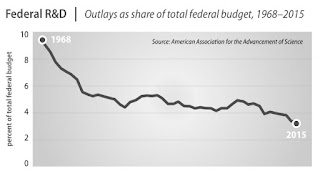

In a 1988 radio address, President Ronald Reagan said, “Although basic research does not begin with

a particular practical goal, when you look at the results over the years, it

ends up being one of the most practical things government does.” Since then, as the

percentage of U.S. budgets used for healthcare constantly rose, national R&D funding (as a percent of GDP, below) gradually eroded. With this, Reagan’s vision of a shining city on a

hill faded from America's national consciousness.

The global economy is constantly evolving.

Also in 1988, China’s overheated economy grew by 11.3%,

before the Beijing massacre throttled foreign investment. Twenty-five years

later in 2013, the Battelle Memorial Institute estimated that by 2020 China

would spend >US$600 billion annually on R&D (up from $284 billion, or

2% of GDP in 2014), as compared to an estimated US$465 billion currently being

spent in the U.S. (or 2.8% of GDP in 2014). The recent Great Fall of China's stock

market will likely impact this 2020 projection, in both China and the

U.S.

The U.S. government has been good to U.S. entrepreneurs.

Over the past four decades, government investment has

been the greatest competitive advantage for Silicon Valley high-tech and biotech venture capital (VC). Publicly funded science, largely based at

research-intensive universities (from National Institutes of Health [NIH],

National Science Foundation [NSF]) and often defense-related (from U.S. Department

of Defense & DARPA) created and continues to fuel new information discovery (see post #57).

Big governments remain major innovation ecosystem

influencers.

While bank loans and VC investors need to be repaid, the NIH’s

Small Business Innovation Research (SBIR) and Small Business Technology

Transfer (STTR) programs do not. This offers entrepreneurs non-dilutive government

financing – free government capital

– that can positively inflect the business trajectory of Newco growth.

Neal F. Lane (above), former NSF Director (1993-98) and U.S. President Bill Clinton's Director for Science & Technology Policy (1998-2001), testified on July 17, 2014 before the U.S. Senate Committee on Commerce, Science and Transportation. Lane said, “Investments in basic research are just that: Investments.” In fact, many experts agree that the U.S. federal government’s R&D funding programs should be viewed as a strategic capital investment in the country’s world-leading status.

Neal F. Lane (above), former NSF Director (1993-98) and U.S. President Bill Clinton's Director for Science & Technology Policy (1998-2001), testified on July 17, 2014 before the U.S. Senate Committee on Commerce, Science and Transportation. Lane said, “Investments in basic research are just that: Investments.” In fact, many experts agree that the U.S. federal government’s R&D funding programs should be viewed as a strategic capital investment in the country’s world-leading status.

Universities are the roads and bridges of the U.S. innovation infrastructure.

University leaders are growing concerned about the future of

this government-academia relationship. A 2015 report from Massachusetts Institute

of Technology (MIT) Committee to Evaluate the Innovation Deficit – The Future Postponed – warned that

reduced U.S. government spending on basic research negatively impacts its

position as a leading global innovator. The MIT report highlighted multiple missed

opportunities from federal under-funding of research on Alzheimer’s disease

(affecting >5,000,000 Americans), Ebola virus biology, and antibiotic resistant

infectious diseases.

Unlike governments and private equity funds, the academic

world is highly transparent.

Universities value the publication of scholarly work in

publicly available high-impact journals. Unlike publicly traded shares on Wall

Street, the private equity VC space completely lacks financial transparency,

other than that required to maintain the trust relationships of general

partners with their limited partner investors. While technology transfer

offices of leading research-intensive universities are part of the innovation

food chain, real “deals” occur when (generally)

young entrepreneurs emerge from academic “caves”

to lead innovation in the marketplace. And while universities are often sophisticated

institutional investors (see University of California [UC] portfolio, below),

real VC deals are almost always made outside universities.

In 2003, UC Berkeley’s Henry Chesbrough (above) defined “open innovation” as the use of

purposeful inflows & outflows of knowledge to accelerate internal

innovation, and expand markets for the external use of innovations. Per Professor

Chesbrough, this concept “falls directly

in that gap in the relationship between business and academe.” Hank has

since described five “erosion factors”

leading to greater corporate VC investment in the open innovation ecosystem.

One such factor is the great R&D capability of research-intensive universities,

which generally function in a private equity-free manner.

The relationship between great countries and their great

universities is compelling.

The U.S. has 26.8% of the top 500 global universities in the

latest U.S. News & World Report

rankings, followed distantly by Germany at 8.4%. In every ranking list, UC

Berkeley, Stanford, Harvard and MIT are the top 4 in the world!

University-generated new information is a constantly refreshing supply of free intellectual fodder for the strategically co-located San Francisco

Bay and Boston innovation clusters.

Research activity at major universities is not a sine quo non for innovation.

It is the seasoned start-up managers beyond carved-in-stone university

gates, and not the learned professors inside them, who are the keys to

entrepreneurial and innovation success. They are the “wise objects” that guide entrepreneurs’ entry into the rocky

business development and distribution channel.

For example, Dr. Larry Lasky (above) left the Genentech (“there’s no B.S. in biotech”) corporate world as a lead scientist in 2002 to enter the private equity world as a founding investor and general partner. His VC “exit” successes include Proteolix (acquired by Onyx Pharmaceuticals), Oncomed, Cellective Therapeutics (acquired by Medimmune), Tetralogic and BioVerdant. Larry says, “We are living in an extraordinary era of discovery in molecular medicine and cellular biology.” Dr. Lasky, forever a serious scientist despite evolving into a VC whale, devours articles daily from journals like Nature, Cell, and Science.

The academic research engine is very different from the

entrepreneurial activity density found in industry sectors (especially high-tech)

and geographic innovation clusters (like the Silicon Valley). An extreme

example is Israel, which has only a fraction of the number of universities

found in the U.S. (<10 versus >4,700), but has 3-times the VC density of the U.S.. Israel’s number of billionaire

entrepreneurs per one million population exceeds the U.S. (see figure below).

A 2015 Deloitte survey of >200 VC funds managing >$50M

each rated Israel #2 in the world (after the U.S.) for startup investing. The

Israeli government, through the Office of the Chief Scientist in the Ministry

of Economy, doesn’t rely solely on its universities, instead making direct investments

in its entrepreneurs and their startups (see Chief Scientist, Avi Hassan

@BIO2015 below).

With sound government R&D policy, great nations leverage

great science.

With experienced VC’s managing the process, great science becomes

real deals.

When this virtuous cycle is intact, true innovation happens.

As the forces buffeting global security and markets grow in strength and

complexity, we in the Square say “Hail, Hail,

Freedonia!” to the wise objects, and enlist in the continuing VC insurgency.

No comments:

Post a Comment